Long-term Bitcoin Price Prediction and Future Market Outlook

Bitcoin, the pioneering cryptocurrency, has captivated investors and technologists alike since its inception. Its volatile price history, driven by a complex interplay of technological advancements, regulatory shifts, and market sentiment, makes predicting its long-term trajectory a fascinating, yet challenging, endeavor. This exploration delves into the historical performance of Bitcoin, analyzing key factors that have shaped its value and projecting potential future scenarios based on various assumptions about adoption rates, technological developments, and the broader macroeconomic landscape.

We will examine both bullish and bearish possibilities, providing a comprehensive overview of the potential future of this revolutionary digital asset.

Understanding Bitcoin’s future requires a multifaceted approach. We will investigate the influence of institutional adoption, the evolution of its underlying technology, and the impact of evolving regulatory frameworks across different global economies. Further, we will analyze the role of market sentiment, investor behavior, and the fundamental supply and demand dynamics that underpin Bitcoin’s value proposition. By considering these factors, we aim to provide a well-rounded perspective on the potential long-term price movements of Bitcoin.

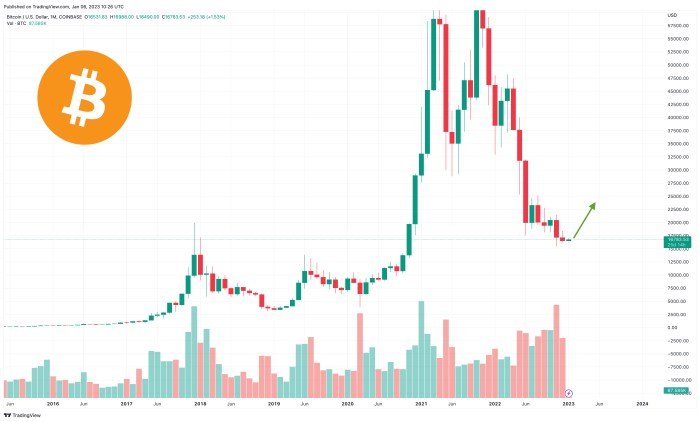

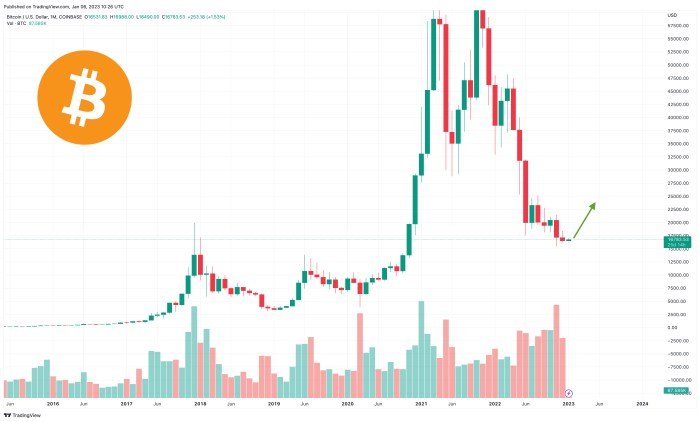

Bitcoin’s Historical Price Performance

Understanding Bitcoin’s past price movements is crucial for predicting its future trajectory. Since its inception, Bitcoin has experienced periods of dramatic growth (bull markets) and significant decline (bear markets), shaped by a complex interplay of technological advancements, regulatory changes, and macroeconomic factors. Analyzing these historical trends provides valuable insights into potential future scenarios.

Bitcoin’s Price Fluctuations

The following table details Bitcoin’s price highs, lows, and percentage changes throughout its history. Note that this data is illustrative and may vary slightly depending on the data source.

| Year | Price High (USD) | Price Low (USD) | Percentage Change |

|---|---|---|---|

| 2010 | 0.30 | 0.00 | N/A |

| 2011 | 31.91 | 2.00 | +1495.5% |

| 2012 | 13.89 | 4.81 | -188.0% |

| 2013 | 1147.25 | 67.65 | +1594.6% |

| 2014 | 957.60 | 171.50 | -82.0% |

| 2015 | 478.34 | 152.91 | -68.4% |

| 2016 | 998.32 | 314.25 | +217.3% |

| 2017 | 19783.06 | 755.80 | +1517.2% |

| 2018 | 17527.88 | 3122.43 | -82.2% |

| 2019 | 13868.71 | 3236.02 | +330.1% |

| 2020 | 29099.40 | 6461.92 | +350.5% |

| 2021 | 68789.63 | 28820.00 | +138.4% |

| 2022 | 48917.00 | 15500.00 | -68.4% |

Comparative Price Analysis

A line graph comparing Bitcoin’s price performance against gold and the S&P 500 would visually demonstrate its volatility relative to more established assets. The graph would show three lines representing the price movements of each asset over time. Bitcoin’s line would likely exhibit significantly greater peaks and troughs compared to the smoother trajectories of gold and the S&P 500, highlighting its higher risk and potential for higher returns.

The periods of strong correlation between Bitcoin and traditional assets would be evident, as well as periods of decoupling, demonstrating its unique characteristics as a digital asset.

Influential Factors on Bitcoin’s Price

Several factors have historically influenced Bitcoin’s price. These include regulatory announcements (e.g., China’s mining bans), technological advancements (e.g., the Lightning Network), macroeconomic events (e.g., inflation and global economic uncertainty), and significant market events (e.g., the collapse of FTX).

Adoption and Technological Factors

The widespread adoption of Bitcoin and advancements in its underlying technology are key drivers of its long-term price. Institutional investment and technological scalability are crucial elements in shaping its future.

Impact of Institutional Adoption

Increased institutional adoption, such as investments by large corporations and financial institutions, could significantly boost Bitcoin’s price by increasing demand and legitimizing it as an asset class. This increased legitimacy could attract further investment, creating a positive feedback loop.

Future of Bitcoin’s Technology

Source: cimg.co

The following table compares current limitations of Bitcoin’s technology with potential future improvements:

| Aspect | Current Limitation | Potential Future Improvement |

|---|---|---|

| Transaction Speed | Relatively slow transaction processing | Layer-2 scaling solutions (e.g., Lightning Network) and protocol upgrades |

| Transaction Fees | Can be high during periods of high network activity | Improved scalability and fee optimization mechanisms |

| Energy Consumption | High energy consumption due to Proof-of-Work consensus mechanism | Potential transition to more energy-efficient consensus mechanisms (though debated) |

Threats to Bitcoin’s Dominance

While Bitcoin currently holds a dominant position, several factors could threaten its dominance. These include the emergence of competing cryptocurrencies with superior technology or features, significant technological disruptions, and regulatory actions that disproportionately affect Bitcoin.

Regulatory Landscape and Geopolitical Influences

The regulatory environment and geopolitical events significantly impact Bitcoin’s price and adoption. Different countries’ approaches to regulating cryptocurrencies create varied market dynamics and investment opportunities.

Impact of Varying Regulatory Approaches

Differing regulatory approaches across countries can create significant price discrepancies. Favorable regulations can attract investment and increase demand, while restrictive regulations can stifle growth and decrease value. This creates a complex and dynamic global landscape for Bitcoin.

Geopolitical Events and Macroeconomic Factors

Geopolitical instability, inflation, and recessionary periods can influence investor behavior and Bitcoin’s perceived value as a safe haven or hedge against inflation. These factors can lead to significant price volatility.

Regulatory Environments in Major Economies

- United States: A fragmented regulatory landscape with ongoing debates about how to classify and regulate Bitcoin.

- China: A highly restrictive environment with bans on cryptocurrency trading and mining.

- European Union: Developing a comprehensive regulatory framework for cryptocurrencies, aiming for a balanced approach.

- El Salvador: Bitcoin is legal tender, fostering a unique regulatory environment and encouraging adoption.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior play a significant role in Bitcoin’s price volatility. Social media, news coverage, and emotional responses drive price fluctuations.

Influence of Social Media and News Coverage

Social media platforms and news outlets can significantly influence Bitcoin’s price through the spread of both positive and negative sentiment. Viral news stories, influencer opinions, and FUD (fear, uncertainty, and doubt) can trigger dramatic price swings.

Investor Sentiment and Trading Volume

Investor sentiment, characterized by fear and greed, directly impacts trading volume and price fluctuations. For example, a period of intense fear might lead to a sell-off, driving the price down, while excessive greed could fuel a speculative bubble, pushing the price to unsustainable highs. A hypothetical scenario could involve a major regulatory announcement: positive news could trigger a surge in buying, while negative news could cause a sharp decline.

Past Market Events Influencing Investor Behavior

Several past events, such as the Mt. Gox hack in 2014 and the collapse of FTX in 2022, dramatically influenced investor behavior and Bitcoin’s price. These events highlighted the risks associated with Bitcoin and caused significant market corrections.

Supply and Demand Dynamics

Bitcoin’s limited supply is a fundamental factor influencing its long-term price. The fixed supply of 21 million coins creates scarcity, potentially driving price appreciation over time.

Role of Bitcoin’s Limited Supply

The inherent scarcity of Bitcoin, with a maximum supply of 21 million coins, contrasts sharply with traditional fiat currencies, which can be printed without limit. This limited supply is a key argument for Bitcoin’s long-term value proposition.

Impact of Bitcoin Mining

Bitcoin mining plays a crucial role in securing the network and creating new coins. The rate at which new coins are added to the supply is predetermined and gradually decreases over time (halving events). This controlled supply release influences the overall market dynamics.

Current and Projected Supply

Comparing the current supply of Bitcoin with projected future supply reveals the gradual reduction in the rate of new coin creation. This decreasing supply, combined with potentially increasing demand, could contribute to price appreciation in the long term.

Potential Future Scenarios

Predicting Bitcoin’s future price is inherently uncertain. However, by considering various factors, we can Artikel three potential scenarios for the next 5-10 years: bullish, bearish, and neutral.

Bullish Scenario

In a bullish scenario, widespread institutional adoption, technological advancements, and favorable regulatory environments could drive Bitcoin’s price to significantly higher levels. Assumptions include substantial institutional investment, successful scaling solutions, and growing global acceptance. This scenario could see Bitcoin reaching prices significantly higher than its previous all-time high.

Bearish Scenario

A bearish scenario involves a combination of factors that could suppress Bitcoin’s price. This could include increased regulatory scrutiny, technological disruptions, significant security breaches, or a broader economic downturn. In this scenario, Bitcoin’s price could experience prolonged periods of stagnation or decline, potentially falling below its previous lows.

Neutral Scenario

A neutral scenario assumes a more balanced outlook, with a mix of positive and negative factors impacting Bitcoin’s price. This scenario might involve moderate adoption, ongoing technological improvements, and a relatively stable regulatory landscape. In this case, Bitcoin’s price could fluctuate within a defined range, neither experiencing dramatic gains nor significant losses.

Visual Representation of Scenarios

A line graph depicting these three scenarios would show three distinct lines representing the price trajectory under each scenario over the next 5-10 years. The bullish scenario would show a steep upward trend, the bearish scenario a downward trend, and the neutral scenario a relatively flat line with some fluctuations.

Catalysts for Each Scenario

Several catalysts could trigger each scenario. For example, a major technological breakthrough or widespread institutional adoption could drive the bullish scenario, while a major security incident or global economic crisis could lead to the bearish scenario. A relatively stable regulatory environment and moderate adoption could lead to the neutral scenario.

Final Review

Predicting the future price of Bitcoin remains inherently speculative, given the volatile nature of the cryptocurrency market and the multitude of interacting factors at play. However, by carefully analyzing historical trends, technological advancements, regulatory developments, and market sentiment, we can develop informed scenarios for Bitcoin’s potential future. While the path ahead is uncertain, a thorough understanding of these dynamics is crucial for investors and anyone interested in the future of decentralized finance.

The journey into the potential future of Bitcoin reveals a complex interplay of technological innovation, regulatory uncertainty, and market forces, highlighting both the risks and rewards associated with this pioneering digital asset. Ultimately, informed decision-making hinges on a comprehensive understanding of these multifaceted influences.

Clarifying Questions

What are the main risks associated with investing in Bitcoin?

Bitcoin’s price is highly volatile, meaning significant losses are possible. Regulatory uncertainty and technological disruptions also pose risks. It’s crucial to conduct thorough research and only invest what you can afford to lose.

How does Bitcoin mining impact its price?

Bitcoin mining secures the network and creates new Bitcoin. The rate at which new Bitcoin is created is programmed to decrease over time, influencing supply and potentially affecting price. Increased mining difficulty can also impact profitability and thus the supply of Bitcoin.

Is Bitcoin a good hedge against inflation?

Some argue that Bitcoin’s limited supply and decentralized nature make it a potential hedge against inflation. However, its price volatility makes this a complex and debated topic. Its correlation with traditional assets is also not consistently established.

What are some alternative cryptocurrencies to Bitcoin?

Many alternative cryptocurrencies exist, each with its own features and functionalities. Examples include Ethereum, Solana, and Cardano. However, each carries its own set of risks and potential rewards.