Long-term Cryptocurrency Price Prediction and Market Analysis

Navigating the dynamic world of cryptocurrency requires a keen understanding of its long-term potential. This analysis delves into the historical trends of major cryptocurrencies, exploring the intricate interplay of technological advancements, regulatory landscapes, and macroeconomic factors that shape their price movements. We’ll examine proven analytical methods, assess inherent risks, and project potential future scenarios, equipping you with a comprehensive perspective on this evolving asset class.

Through a detailed examination of historical price data, technical indicators, and fundamental project analysis, we aim to provide a balanced and insightful overview of long-term cryptocurrency investment strategies. Understanding the past, present, and potential future trajectories of these digital assets is crucial for informed decision-making in this exciting yet volatile market.

Historical Cryptocurrency Price Trends

Understanding the historical price movements of cryptocurrencies is crucial for predicting future trends. Analyzing past performance, coupled with an understanding of the events that influenced those movements, provides valuable insights for long-term investment strategies. This section will detail significant price changes for major cryptocurrencies like Bitcoin and Ethereum, compare their performance, and present a historical price overview in tabular format.

Significant Price Movements and Influencing Events

Bitcoin, the pioneer cryptocurrency, experienced a meteoric rise from its inception in 2009 to its peak in late 2017, driven by factors such as increasing adoption, media attention, and speculation. Subsequent years saw periods of both significant growth and sharp corrections, influenced by regulatory announcements, technological advancements, and macroeconomic shifts. Ethereum, launched in 2015, followed a similar trajectory, experiencing substantial growth alongside Bitcoin but also exhibiting periods of independent price movements due to its unique functionalities and ecosystem.

Major events such as the 2017 ICO boom, the 2020 DeFi summer, and the various Bitcoin halving events significantly impacted the prices of both cryptocurrencies. For example, the 2021 bull run saw Bitcoin exceed $60,000 and Ethereum reach nearly $4,500, driven partly by institutional adoption and the growth of decentralized finance (DeFi).

Bitcoin vs. Other Cryptocurrencies: A Five-Year Comparison

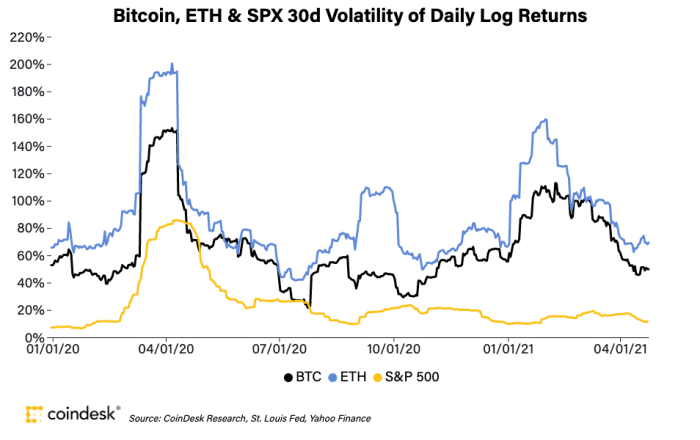

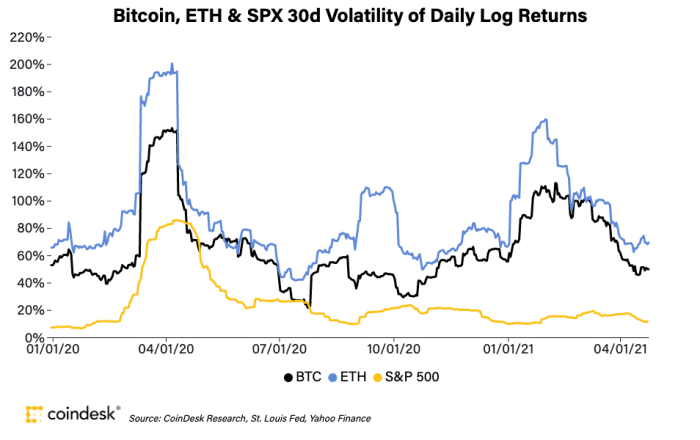

Over the past five years, Bitcoin and other prominent cryptocurrencies have shown periods of both correlation and divergence in their price movements. While often moving in tandem during major market shifts, individual cryptocurrencies have exhibited unique price patterns based on their underlying technology, adoption rates, and market sentiment. For instance, during periods of overall market bullishness, altcoins (alternative cryptocurrencies) often outperform Bitcoin, showcasing higher volatility and potential for greater gains.

Conversely, during market downturns, the correlation between Bitcoin and altcoins tends to strengthen, with altcoins often experiencing sharper declines. This highlights the importance of diversified portfolios and a thorough understanding of individual cryptocurrency dynamics.

Yearly High and Low Prices for Bitcoin and Ethereum

| Year | Bitcoin High (USD) | Bitcoin Low (USD) | Ethereum High (USD) | Ethereum Low (USD) |

|---|---|---|---|---|

| 2018 | 17,700 | 3,122 | 1,432 | 84 |

| 2019 | 13,850 | 3,155 | 364 | 107 |

| 2020 | 29,000 | 6,476 | 600 | 86 |

| 2021 | 68,789 | 28,800 | 4,356 | 1,073 |

| 2022 | 48,000 | 15,476 | 4,891 | 882 |

Factors Influencing Long-Term Price Predictions

Predicting long-term cryptocurrency prices requires considering a complex interplay of factors. Regulatory landscapes, technological advancements, macroeconomic conditions, and significant market events all contribute to the overall price trajectory. This section will delve into these key influencers, providing context and examples to illustrate their impact.

Regulatory Frameworks and Cryptocurrency Valuations

Government regulations play a significant role in shaping cryptocurrency markets. Clear and supportive regulatory frameworks can foster institutional adoption and investor confidence, potentially leading to increased price stability and growth. Conversely, overly restrictive or unclear regulations can stifle innovation and create uncertainty, potentially causing price volatility and hindering market development. The regulatory approach varies widely across different jurisdictions, creating a complex and evolving landscape that significantly impacts cryptocurrency valuations.

Technological Advancements and Future Prices

Technological advancements within the cryptocurrency space have a profound impact on long-term price predictions. Scaling solutions, aimed at improving transaction speed and reducing fees, are crucial for mass adoption. New consensus mechanisms, offering improved security and efficiency, also play a significant role. For example, the shift towards more energy-efficient consensus mechanisms like Proof-of-Stake (PoS) could positively influence the perception and valuation of certain cryptocurrencies.

The continuous development and implementation of innovative technologies are critical drivers of long-term price trends.

Macroeconomic Factors and Cryptocurrency Markets

Macroeconomic factors such as inflation, interest rates, and global economic growth exert significant influence on cryptocurrency markets. During periods of high inflation, investors may seek alternative stores of value, potentially driving demand for cryptocurrencies. Similarly, changes in interest rates can impact investment strategies, affecting the flow of capital into or out of cryptocurrency markets. Global economic uncertainty can also lead to increased demand for cryptocurrencies as a hedge against risk.

Understanding these macroeconomic trends is essential for making informed long-term predictions.

Impact of Significant Market Events

Significant market events, such as halving events (in Bitcoin’s case, a reduction in the rate of new coin creation) and major hacks, can significantly affect long-term price trends. Halving events, for instance, historically have been followed by periods of price appreciation due to reduced supply. Major hacks, on the other hand, can erode investor confidence and lead to temporary price declines.

Analyzing the historical impact of such events provides valuable insights into potential future price reactions.

Technical Analysis Methods for Cryptocurrency

Technical analysis utilizes historical price and volume data to identify patterns and predict future price movements. This section will explore several key technical analysis methods applicable to cryptocurrencies, offering a practical guide to their interpretation.

Moving Averages and Long-Term Trends

Moving averages, such as the 50-day and 200-day moving averages, are widely used to identify potential long-term trends. A 50-day moving average smooths out short-term price fluctuations, providing a clearer picture of the underlying trend over a shorter period. The 200-day moving average provides a longer-term perspective. When the shorter-term moving average crosses above the longer-term moving average (a “golden cross”), it’s often interpreted as a bullish signal.

The opposite (a “death cross”) is often viewed as bearish.

Support and Resistance Levels

Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels, conversely, represent price points where selling pressure is anticipated to overcome buying pressure, hindering further price increases. Identifying and monitoring these levels can help predict potential price reversals or breakouts.

Candlestick Patterns and Price Predictions

Candlestick patterns provide visual representations of price movements over specific time periods. Certain patterns, such as hammer, engulfing, and doji patterns, are associated with potential price reversals or continuations. Analyzing candlestick patterns in conjunction with other technical indicators can improve the accuracy of price predictions.

Relative Strength Index (RSI) for Market Momentum Assessment

The Relative Strength Index (RSI) is a momentum indicator used to assess whether a market is overbought or oversold. An RSI value above 70 is generally considered overbought, suggesting a potential price correction. Conversely, an RSI value below 30 is often seen as oversold, suggesting a potential price rebound.

- Step 1: Calculate the average gains and losses over a specified period (e.g., 14 days).

- Step 2: Calculate the Relative Strength (RS) by dividing the average gain by the average loss.

- Step 3: Calculate the RSI using the formula: RSI = 100 – (100 / (1 + RS)).

- Step 4: Analyze the RSI value to determine market momentum and potential overbought/oversold conditions.

Fundamental Analysis of Cryptocurrency Projects

Fundamental analysis focuses on evaluating the underlying value of a cryptocurrency project, considering its technology, team, tokenomics, and overall market position. This section will Artikel key aspects of fundamental analysis and provide a comparative analysis of three major cryptocurrencies.

Evaluating Underlying Technology and Use Cases

A crucial aspect of fundamental analysis involves assessing the underlying technology and its practical applications. This includes examining the scalability, security, and efficiency of the blockchain network, as well as the real-world use cases for the cryptocurrency. A strong technological foundation and clear use cases are key indicators of long-term potential.

Assessing the Team and Credibility

The team behind a cryptocurrency project plays a vital role in its success. Analyzing the team’s experience, expertise, and reputation is essential. A strong, transparent, and experienced team enhances the credibility and trustworthiness of the project.

Examining Tokenomics

Tokenomics refers to the economic model of a cryptocurrency, encompassing its total supply, distribution mechanism, and utility. Understanding the tokenomics is crucial for assessing the long-term value proposition. Factors such as inflation rates, token burning mechanisms, and token utility directly impact the cryptocurrency’s price and overall market dynamics.

Comparison of Three Major Cryptocurrencies

| Cryptocurrency | Strengths | Weaknesses | Tokenomics |

|---|---|---|---|

| Bitcoin | First-mover advantage, established network, strong brand recognition | Limited scalability, high transaction fees (historically), energy consumption (PoW) | Fixed supply of 21 million coins |

| Ethereum | Smart contract functionality, diverse ecosystem, large developer community | Scalability challenges (historically), high gas fees (historically) | No fixed supply, but inflation rate is decreasing |

| Solana | High transaction speed, low transaction fees, strong developer ecosystem | Centralization concerns, network outages in the past | Inflationary token model with a capped maximum supply |

Risk Assessment in Long-Term Cryptocurrency Investments

Long-term cryptocurrency investments involve inherent risks. Understanding these risks and implementing effective mitigation strategies is crucial for successful investing. This section will Artikel key risks and strategies for managing them.

Key Risks Associated with Long-Term Cryptocurrency Investments

Volatility is a prominent risk, with cryptocurrency prices subject to significant fluctuations. Regulatory uncertainty, stemming from the evolving regulatory landscape, creates another major risk. Security breaches, targeting exchanges or individual wallets, pose a significant threat to investor funds. Furthermore, the nascent nature of the cryptocurrency market and its susceptibility to manipulation also present substantial risks.

Strategies for Mitigating Risks

Diversification across different cryptocurrencies and asset classes helps reduce exposure to individual project risks. Implementing risk management techniques, such as setting stop-loss orders and utilizing dollar-cost averaging, can help limit potential losses. Thorough due diligence and a conservative investment approach are essential for minimizing risk.

Historical Events Illustrating the Importance of Risk Management

Numerous historical events underscore the importance of risk management in cryptocurrency investing. The 2018 cryptocurrency bear market, for example, saw significant price declines, highlighting the need for diversified portfolios and risk mitigation strategies. The collapse of various cryptocurrency exchanges also demonstrates the importance of choosing reputable platforms and securing private keys.

Potential Future Scenarios for Cryptocurrency Markets

Predicting the future of cryptocurrency markets is inherently challenging, but considering different scenarios helps investors prepare for various outcomes. This section Artikels three potential scenarios for the next five years.

Bullish Scenario

Source: arcpublishing.com

In a bullish scenario, widespread institutional adoption, coupled with positive regulatory developments and technological advancements, drives significant price appreciation for major cryptocurrencies. Bitcoin could potentially exceed $100,000, while Ethereum and other leading altcoins experience substantial gains. This scenario would likely be fueled by increased investor confidence, growing market maturity, and the integration of cryptocurrencies into mainstream finance.

Bearish Scenario

A bearish scenario involves increased regulatory scrutiny, negative macroeconomic conditions, or major security breaches that lead to a significant market downturn. Bitcoin’s price could potentially fall below its previous lows, while altcoins experience even sharper declines. This scenario could be driven by factors such as a global economic recession, heightened regulatory pressure, or a series of major security incidents that erode investor confidence.

Neutral Scenario

A neutral scenario assumes a period of consolidation and gradual growth. Cryptocurrency prices experience moderate fluctuations, with neither significant gains nor sharp declines. This scenario reflects a more balanced outlook, characterized by cautious adoption, ongoing regulatory uncertainty, and technological advancements that gradually improve market efficiency and stability.

Last Word

The cryptocurrency market remains a complex and evolving landscape. While predicting the future with absolute certainty is impossible, a thorough understanding of historical trends, technical analysis, fundamental project strengths, and inherent risks provides a crucial foundation for navigating this space. By combining these analytical approaches and considering various future scenarios, investors can make more informed decisions and mitigate potential losses.

The journey into long-term cryptocurrency investment requires diligence, continuous learning, and a realistic assessment of both the opportunities and challenges involved.

User Queries

What are the limitations of long-term cryptocurrency price predictions?

Long-term price predictions are inherently uncertain due to the volatile nature of the cryptocurrency market and the influence of unpredictable external factors like regulatory changes and technological disruptions. Predictions should be viewed as potential scenarios, not guarantees.

How can I diversify my cryptocurrency portfolio to mitigate risk?

Diversification involves investing in a range of cryptocurrencies with different underlying technologies and use cases. It also includes considering other asset classes to reduce overall portfolio volatility. No single strategy guarantees success, and careful research is crucial.

What role does regulation play in long-term cryptocurrency price predictions?

Regulatory frameworks significantly impact cryptocurrency valuations. Favorable regulations can boost investor confidence and increase adoption, while stricter rules can dampen market growth and price appreciation. Regulatory uncertainty itself presents a significant risk factor.

Are there any ethical considerations in cryptocurrency investment?

Ethical considerations include understanding the environmental impact of certain cryptocurrencies (energy consumption), the potential for illicit activities (money laundering), and the responsible use of investment strategies. Informed and ethical investing is paramount.