How to Avoid Cryptocurrency Scams and Phishing Attacks

The world of cryptocurrency offers incredible potential, but it also harbors significant risks. Sophisticated scams and phishing attacks target unsuspecting investors daily, leading to substantial financial losses. Understanding the tactics employed by these criminals, recognizing warning signs, and implementing robust security measures are crucial for protecting your digital assets. This guide will equip you with the knowledge and strategies to navigate the cryptocurrency landscape safely and confidently.

From identifying fraudulent investment opportunities to securing your digital wallets and reporting suspicious activity, we’ll explore a comprehensive approach to safeguarding your cryptocurrency holdings. We will delve into the psychology behind these scams, revealing the manipulative techniques used to exploit emotions and gain trust. Ultimately, this guide aims to empower you to make informed decisions and protect yourself from the ever-evolving threats in the cryptocurrency space.

Understanding Cryptocurrency Scams and Phishing Attacks

The cryptocurrency landscape, while offering immense potential, is unfortunately plagued by scams and phishing attacks designed to steal your digital assets. Understanding the various methods employed by scammers is crucial to protecting yourself. This section will delve into the different types of cryptocurrency scams, common tactics, and real-world examples to illustrate the threats.

Types of Cryptocurrency Scams and Phishing Attacks

Cryptocurrency scams manifest in diverse forms, each employing unique tactics to exploit vulnerabilities. These include, but are not limited to, fake exchanges, pump-and-dump schemes, romance scams, and phishing attacks targeting wallets and exchanges.

Common Scamming Tactics

Scammers often leverage sophisticated tactics to deceive victims. These include creating a sense of urgency, employing high-pressure sales techniques, promising unrealistic returns, and leveraging social engineering to gain trust. They often impersonate legitimate entities or individuals to build credibility.

Real-World Examples

Numerous real-world examples highlight the insidious nature of these scams. For instance, the 2021 BitConnect scam, which promised exorbitant returns through a purported lending platform, defrauded thousands of investors. Phishing emails mimicking legitimate exchanges, requesting login credentials or private keys, are another prevalent tactic.

Comparison of Scam Types

| Scam Type | Characteristics | Red Flags | Examples |

|---|---|---|---|

| Fake Exchanges | Mimic legitimate exchanges, often with similar branding and user interfaces. | Unverified security measures, lack of regulation, unusual fees, difficulty withdrawing funds. | Websites that closely resemble popular exchanges but operate fraudulently. |

| Pump and Dump | Scammers artificially inflate the price of a cryptocurrency before selling off their holdings, leaving investors with losses. | Sudden and unexplained price surges, coordinated social media campaigns, anonymous promoters. | Coordinated efforts to hype a low-value cryptocurrency on social media, followed by a rapid price drop. |

| Romance Scams | Scammers build relationships with victims online before requesting cryptocurrency investments or gifts. | Unrealistic promises of love and future together, requests for financial assistance under various pretenses, evasiveness about personal details. | Individuals creating fake profiles on dating sites to lure victims into financial schemes. |

| Phishing Attacks | Emails, text messages, or websites designed to steal login credentials or private keys. | Suspicious links, grammatical errors, requests for personal information, urgent tone. | Emails that appear to be from a legitimate exchange but contain malicious links. |

Identifying Red Flags and Warning Signs

Recognizing red flags is the first line of defense against cryptocurrency scams. This section will Artikel common warning signs and suspicious communication patterns used by scammers to manipulate victims.

Common Red Flags

Several indicators frequently signal fraudulent investment opportunities. These include guarantees of high returns with minimal risk, unsolicited investment advice, pressure to invest quickly, and lack of transparency about the investment’s details.

Suspicious Communication Patterns

Scammers often employ manipulative communication tactics. These involve creating a sense of urgency, using high-pressure sales techniques, employing emotional appeals, and offering exclusive or limited-time opportunities. They may also use flattery or build trust before making their requests.

Checklist of Warning Signs

A comprehensive checklist can help individuals assess the legitimacy of cryptocurrency-related requests. This checklist should include verifying the sender’s identity, scrutinizing website security, researching the investment opportunity independently, and avoiding any requests for urgent action or personal information.

Examples of Suspicious Websites and Email Addresses

Examples of suspicious websites often include those with poor grammar, misspellings, or unusual domain names. Email addresses may use free email services or contain unusual characters or numbers. It’s crucial to always verify the authenticity of any website or email before interacting with it.

Safeguarding Your Cryptocurrency Holdings

Securely storing and managing your cryptocurrency is paramount to protecting your assets. This section will discuss best practices for securing your digital assets and accounts.

Secure Storage and Management

Hardware wallets provide the most secure method of storing cryptocurrency, offering offline protection against hacking attempts. Software wallets, while convenient, require robust security measures. Diversifying your holdings across multiple wallets can further mitigate risk.

Importance of Strong Passwords and Two-Factor Authentication

Employing strong, unique passwords for each cryptocurrency account is crucial. Two-factor authentication (2FA) adds an extra layer of security, requiring a second verification method, such as a code sent to your phone, to access your account.

Securing Your Devices

Regularly updating your operating system and software is vital in protecting against malware and phishing attempts. Installing reputable antivirus and anti-malware software can help detect and block malicious programs. Using a firewall can also help protect your network from unauthorized access.

Step-by-Step Guide for Secure Account Creation and Management

- Choose a reputable exchange or wallet provider.

- Create a strong, unique password.

- Enable two-factor authentication.

- Regularly review your account activity for suspicious transactions.

- Keep your software and operating systems updated.

- Use a reputable antivirus program.

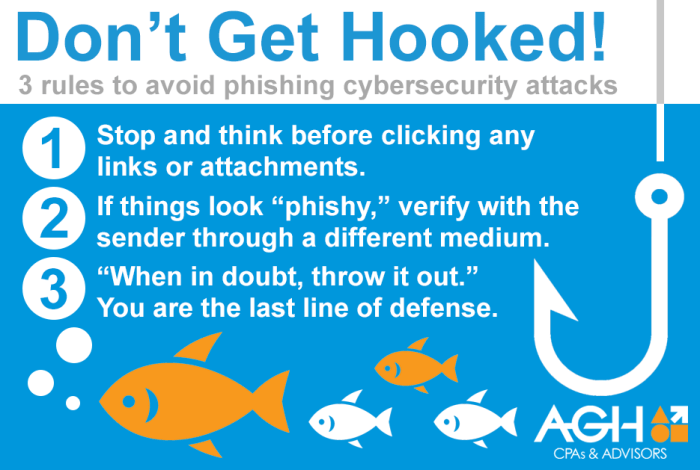

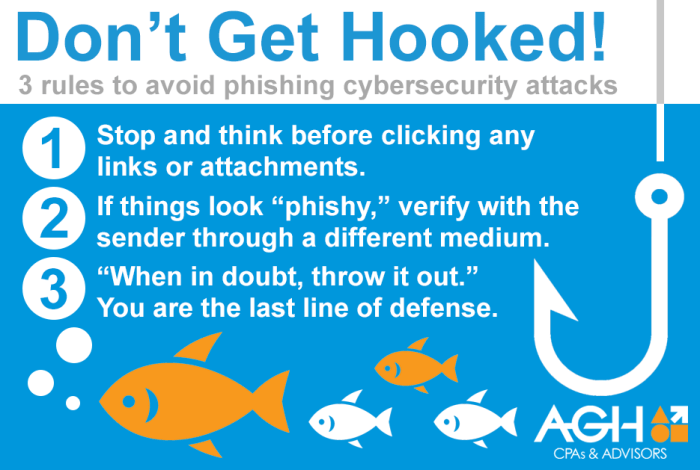

Protecting Yourself from Phishing Attacks

Phishing attacks are a common method used to steal cryptocurrency. This section will detail how to identify and avoid these attacks.

Common Phishing Techniques

Phishing attacks often mimic legitimate communications, such as emails from exchanges or wallet providers, containing malicious links or attachments. SMS messages (smishing) are also used to trick victims into revealing sensitive information.

Verifying Website and Email Legitimacy

Always verify the legitimacy of websites and email addresses before clicking any links or providing personal information. Check the URL for any misspellings or inconsistencies, and look for security indicators such as HTTPS.

Spotting Fake Exchanges and Wallets

Fake cryptocurrency exchanges and wallets often have poor designs, grammatical errors, or lack of proper security measures. Research the platform thoroughly before using it and check for reviews and testimonials from other users.

Actions to Take if You Suspect a Phishing Attack

- Do not click any links or attachments.

- Change your passwords immediately.

- Report the incident to the relevant authorities.

- Monitor your accounts for any unauthorized activity.

Reporting and Prevention

Knowing how to report scams and implement preventative measures is crucial for community safety. This section Artikels the necessary steps and resources.

Steps to Take After a Scam or Phishing Attack

Report the incident to the relevant authorities, including law enforcement and the platform involved. Change your passwords immediately and monitor your accounts for any suspicious activity. Consider seeking legal advice.

Resources for Reporting Cryptocurrency Scams

Several resources exist for reporting cryptocurrency scams and phishing attacks, including government agencies, law enforcement, and consumer protection organizations. Specific reporting mechanisms vary by jurisdiction.

Community Initiatives and Educational Resources

Many community initiatives and educational resources aim to raise awareness about cryptocurrency scams and phishing attacks. These often provide valuable information and guidance on how to protect yourself.

Role of Security Software

Employing robust security software, including antivirus and anti-malware programs, is essential in preventing cryptocurrency-related attacks. Regular updates and scans are crucial to maintaining effective protection.

Understanding the Psychology of Scams

Scammers often exploit human psychology to manipulate victims. Understanding these tactics is key to building resilience.

Psychological Manipulation Tactics

Scammers leverage emotions such as greed, fear, and trust to manipulate victims into making impulsive decisions. They often create a sense of urgency or exclusivity to pressure individuals into acting quickly.

Exploiting Emotions

Source: aghlc.com

The promise of quick riches appeals to greed, while threats of financial loss prey on fear. Building trust through fabricated relationships or testimonials can lower a victim’s guard.

Recognizing and Resisting Manipulative Tactics

Taking time to consider investment opportunities, verifying information independently, and resisting pressure tactics are crucial in avoiding scams. Seeking advice from trusted sources can also provide valuable perspective.

Psychological Red Flags

- Unrealistic promises of high returns.

- Pressure to invest quickly.

- Secrecy or lack of transparency.

- Requests for personal information.

- Use of emotional appeals.

Due Diligence in Cryptocurrency Investments

Thorough research is vital before investing in any cryptocurrency. This section Artikels the steps to conduct due diligence.

Importance of Thorough Research

Conducting thorough research helps investors assess the legitimacy and potential of a cryptocurrency project. This includes examining the project’s whitepaper, team, and technology.

Verifying Cryptocurrency Projects and Teams

Investigate the project’s team members, their experience, and their track record. Look for any red flags, such as anonymous team members or a lack of transparency.

Understanding Whitepapers and Tokenomics

A whitepaper Artikels a project’s goals, technology, and tokenomics (the economic model of the cryptocurrency). Understanding these aspects is crucial in assessing the project’s viability.

Step-by-Step Guide on Conducting Due Diligence

- Research the project’s whitepaper and team.

- Analyze the project’s technology and its potential use cases.

- Review the tokenomics and understand how the cryptocurrency will be distributed and used.

- Assess the project’s community and its level of engagement.

- Consider the risks involved and diversify your investments.

Last Recap

Protecting yourself from cryptocurrency scams and phishing attacks requires vigilance, knowledge, and proactive security measures. By understanding the common tactics employed by scammers, recognizing red flags, and implementing the best practices Artikeld in this guide, you can significantly reduce your risk of becoming a victim. Remember, staying informed, being cautious, and regularly updating your security protocols are essential steps in safeguarding your digital assets and ensuring a secure experience in the dynamic world of cryptocurrency.

Questions and Answers

What is a hardware wallet, and how does it differ from a software wallet?

A hardware wallet is a physical device that stores your cryptocurrency offline, offering superior security compared to software wallets (which store keys digitally on your computer or phone). Software wallets are more convenient but are vulnerable to hacking if your device is compromised.

How can I verify the legitimacy of a cryptocurrency project?

Thoroughly research the project’s whitepaper, team members, and community engagement. Look for transparency in their operations and independent audits of their code. Be wary of projects with unrealistic promises or anonymous teams.

What should I do if I think I’ve been scammed?

Immediately cease all communication with the scammer. Gather all relevant information (emails, transactions, etc.). Report the incident to the appropriate authorities (law enforcement, your exchange, etc.). And consider consulting a cybersecurity expert.

Are there any reputable resources for reporting cryptocurrency scams?

Yes, many organizations track and report cryptocurrency scams. Contact your local law enforcement, the Federal Trade Commission (FTC) in the US, or equivalent agencies in other countries. Additionally, many cryptocurrency exchanges have their own reporting mechanisms.